PROJECTS

Where theory meets real world Impact

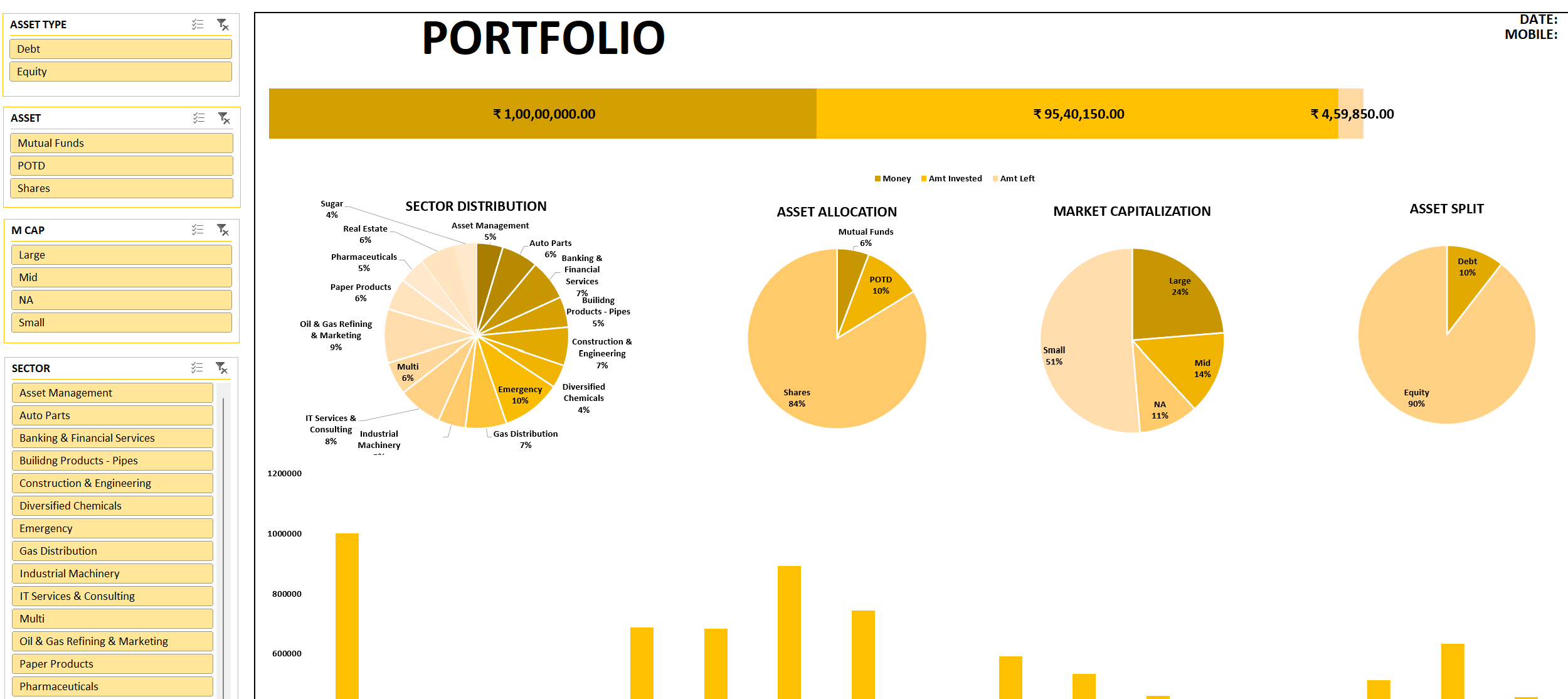

In my Investments course, I created a customized stock portfolio based on a client’s risk profile and financial goals. I researched listed companies, analyzed their fundamentals, and selected a diversified set of stocks aligned with the client's objectives and investment horizon. Using Excel, I structured the portfolio with defined allocations, return expectations, and basic performance tracking. This project strengthened my understanding of practical stock selection, risk-return alignment, and client-focused investment planning.

Portfolio Management Investments Course

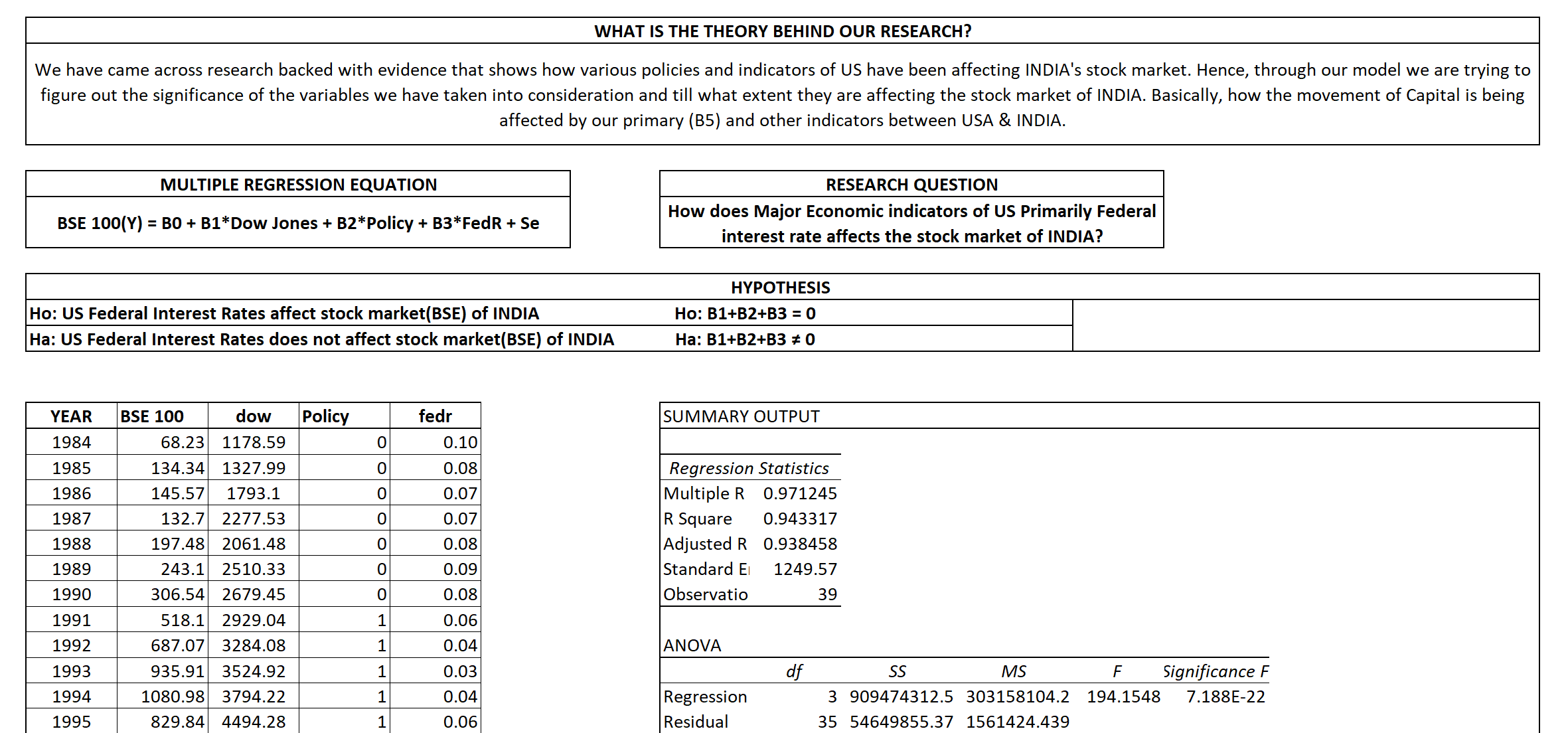

As part of my Econometrics course, I conducted a multiple regression analysis to study the impact of major U.S. economic indicators—particularly federal interest rates—on India’s stock market (BSE 100). Using Excel and R, I built a model with data from 1984 to 2022, incorporating the Dow Jones Index, U.S. monetary policy, and interest rates. The analysis showed a strong correlation, with an R² value of 0.94, highlighting significant influence. This project sharpened my econometric skills and capital movement knowledge.

Factors Affecting BSE Econometrics with R

Team Quadro is collaborating with Voltran to deliver a rigorous Capstone analysis on strategic investment decisions in India’s EV charging market. By combining on-site operator interviews, detailed financial modeling of CAPEX/OPEX, and market benchmarking, we’re assessing the viability of expanding Voltran’s DC fast-charging network versus diversifying into services like battery leasing and subscription plans. Our research will provide data-driven recommendations on ROI, funding strategies, and cost-benefit trade-offs to guide Voltran’s next phase of growth.

Voltran: Strategic Investment Analysis Capstone Project

This term paper examines how foreign direct investment (FDI) inflows, in conjunction with GDP growth and labor‐market indicators, influence U.S. wage trends from 1991–2023. With an R² of 0.92, the model demonstrates strong explanatory power, revealing that while FDI alone boosts wages, its marginal benefit diminishes as GDP growth rises. The findings challenge simplistic views of FDI’s uniform benefits, highlighting the need for targeted policies to ensure equitable wage gains across sectors.

FDI Inflows & Economic Growth: Analyzing Wages in US Industrial Economics & Labor Markets

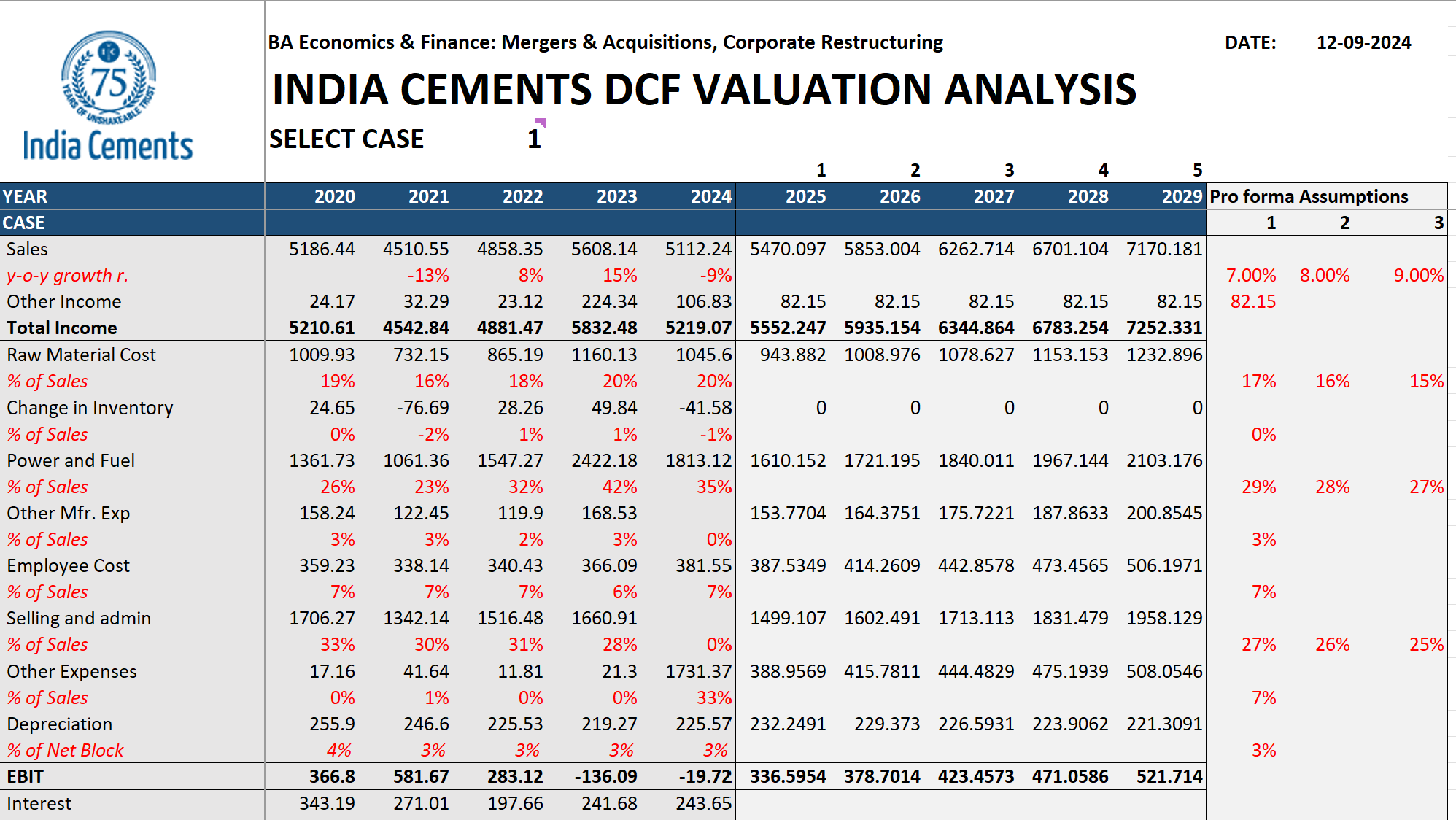

In my M&A course, I conducted a Discounted Cash Flow (DCF) valuation of UltraTech Cement’s $472 million acquisition of a 32.72% stake in India Cements (approved December 2024), building a ten‑year free cash flow forecast that incorporated revenue synergies and cost efficiencies while calculating the appropriate WACC for discounting . I then performed sensitivity analyses on key assumptions and compared the DCF results with an APV approach, sharpening my financial modeling skills and strategic insight into deal valuation.

India Cements DCF Analysis M&A Corporate Restructuring